CT LGL-001 2018-2025 free printable template

Show details

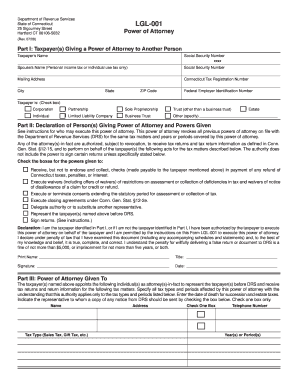

Consult a DRS representative to find out the name and the address or fax number where the LGL-001 should be directed. To contact DRS call 1-800-382-9463 Connecticut calls outside the Greater Hartford calling area only and select Option 2 from a touch-tone phone or 860-297-5962 from anywhere. Department of Revenue Services State of Connecticut 25 Sigourney Street Hartford CT 06106-5032 LGL-001 Power of Attorney RESET FORM Rev. 07/08 Part I Taxpayer s Giving a Power of Attorney to Another...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct lgl 001 form

Edit your form lgl 001 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lgl001 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lgl 001 power of attorney online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ct drs form lgl 001. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT LGL-001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form lgl 001 connecticut

How to fill out CT LGL-001

01

Obtain the CT LGL-001 form from the appropriate state website or office.

02

Fill out the applicant's information in the provided fields (name, address, etc.).

03

Specify the type of legal service for which you are applying.

04

Provide details regarding the purpose of the application.

05

Include any required documentation to support your application.

06

Review the completed form for accuracy and completeness.

07

Sign and date the application where indicated.

08

Submit the form and accompanying documents to the designated office.

Who needs CT LGL-001?

01

Individuals seeking legal recognition or services in Connecticut.

02

Organizations or entities that require legal designation or regulatory compliance.

03

Attorneys filing on behalf of clients for legal processes.

Fill

connecticut department of revenue services

: Try Risk Free

People Also Ask about complete the form

How do I get a tax clearance certificate in CT?

A purchaser who has committed to purchasing the business or stock of goods of a seller may submit Form AU-866, Request for a Tax Clearance Certificate, to the Department of Revenue Services (DRS). The DRS will issue a tax clearance certificate or escrow letter within sixty (60) days of receipt of Form AU-866.

What is a CT LGL 001 form?

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.

Does a CT power of attorney need to be notarized?

Under Connecticut law, a power of attorney must be signed in front of two witnesses and notarized in order to be considered enforceable. Once executed in this manner, the powers are immediately effective unless the document states otherwise.

Who pays real estate transfer tax in CT?

Connecticut's Real Estate Conveyance Tax The seller pays the tax when he or she conveys the property. Municipal town clerks collect the tax and remit the state share to the state Department of Revenue Services (DRS) (CGS §§ 12-494 et seq., as amended by PA 19-117, § 337).

What is a durable medical power of attorney in CT?

A medical power of attorney, also called a durable power of attorney for health care, is a legal document. In it, you grant another person the authority to make medical decisions for you if you become unable to do so. The person you choose is your health care agent (health care proxy, health care surrogate).

What is a medical power of attorney form in CT?

A Connecticut medical power of attorney form, or advance directive, is a legal document that provides an individual with the ability to select their healthcare representative while also providing directions in advance with regard to their end-of-life treatment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my CT LGL-001 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign CT LGL-001 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute CT LGL-001 online?

Filling out and eSigning CT LGL-001 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the CT LGL-001 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your CT LGL-001 in seconds.

What is CT LGL-001?

CT LGL-001 is a legal entity tax return form used in Connecticut for certain business organizations to report their income and calculate their tax obligations.

Who is required to file CT LGL-001?

Filing CT LGL-001 is required for certain business entities, including partnerships, limited liability companies (LLCs), and corporations operating in Connecticut.

How to fill out CT LGL-001?

To fill out CT LGL-001, you must gather financial information about your business, complete the sections for income and deductions, provide your entity's details, and then submit the form to the Connecticut Department of Revenue Services.

What is the purpose of CT LGL-001?

The purpose of CT LGL-001 is to allow the state of Connecticut to collect taxes from legal entities based on their income and to maintain compliance with state tax laws.

What information must be reported on CT LGL-001?

CT LGL-001 requires the reporting of total income, expenses, net profit or loss, entity identification information, and any applicable deductions or tax credits.

Fill out your CT LGL-001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT LGL-001 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.